The 54-year-old hailing from Taiwan’s ancient capital, Tainan, may not be a household name like many of her Silicon Valley peers.

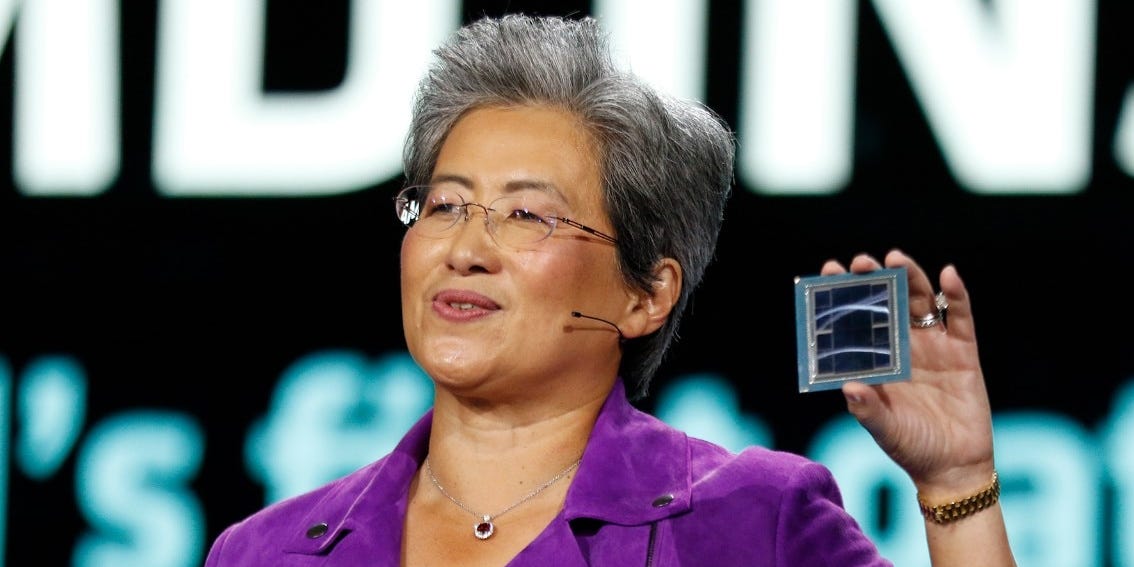

But after a near-decade-long tenure at the helm of Advanced Micro Devices (AMD), Su’s quiet rise to the top bracket of America’s tech industry is starting to get some long-overdue attention.

The CEO of the Santa Clara tech giant, which supplies GPU chips to companies seeking computing power for AI applications, became one of the newest entrants to Forbes’ annual billionaire list published this week.

It’s a huge milestone for Su, whose net worth is now an estimated $1.3 billion. She took over AMD in 2014, when it was rumored to be on the verge of bankruptcy. Now, she’s ready to take the company to new heights to take on her billionaire cousin, Nvidia chief Jensen Huang, who’s worth an estimated $77 billion.

Here’s how Su got to this point, and what could lie ahead for her in the AI era.

Lisa Su’s billionaire journey

Tom Williams/CQ-Roll Call/Getty Images, Jerod Harris/Getty Images for Vox Media

Su, whose family moved to the US when she was three years old, seemed destined to take the path her career has led her on.

After majoring in electrical engineering at MIT and studying for her master’s and Ph.D. at the university, Su stepped into the world of semiconductors and chips by taking on roles at blue-chip businesses like Texas Instruments and IBM, before joining AMD in 2012.

Her role as senior vice president and general manager of AMD’s global business units would eventually gear her up for the CEO position two years later — but success wasn’t guaranteed.

Her predecessor, Rory Read, was leaving behind a company with billions of dollars of debt, had struggled to gain traction for expensive processors it invested heavily in and was being overshadowed by rivals like Intel.

But after taking on a compensation package that incentivized efforts to boost stock performance — she took a lower base pay than Read of $850,000 but was awarded more than six million shares — Su mounted a revival of AMD. The stock has risen more than 60-fold since Su became CEO in 2014, per Forbes.

By focusing on a radically different design of CPUs known as Zen, first released in 2017, Su restored the industry’s confidence in the company’s ability to deliver critical components of computers with vast amounts more power and energy efficiency. The newer versions of these CPUs are used by everyone from Microsoft to Sony in game consoles like the Xbox Series X and PlayStation 5, for instance.

Underestimated

Despite resuscitating AMD from a market cap low of about $2 billion when she took over, Su hasn’t always been given her due.

In a notorious incident on the grid of the Shanghai International Circuit in 2018, ex-Formula One driver Martin Brundle slighted Su, inadvertently, after asking her if she spoke English. Her response? She was there as a sponsor of F1’s most successful team, Ferrari.

Being underestimated is still a reality for Su in the generative AI boom.

As her company has looked to expand its GPU division — now in hot demand due to demand from the likes of OpenAI and Meta — it’s been massively overshadowed by rival Nvidia.

Nvidia CEO Huang, a first cousin once removed of Su, has taken his company to a valuation of more than $2.2 trillion by convincing the AI industry that his GPUs and the community around them have an edge over those from rivals. AMD in contrast is worth $278 billion.

But Su is clearly ready for a challenge. In December, she unveiled AMD’s new MI300X chip as a rival to Nvidia’s top offering, calling it “the most advanced AI accelerator in the industry.”

The likes of Sam Altman’s OpenAI plan to use the chips, which AMD expects to reach $1 billion in sales by mid-2024. The company also forecasts wider growth of the AI industry in the coming years as it targets a valuation of $400 billion by 2027.

For Su then, that means there’s plenty to play for as AI companies show little sign of their interest in computing power disappearing. Su’s billionaire journey could just be getting started.