- Sales of electric cars in China are expected to rise at a slower pace this year.

- That’s likely to be a problem for Tesla too.

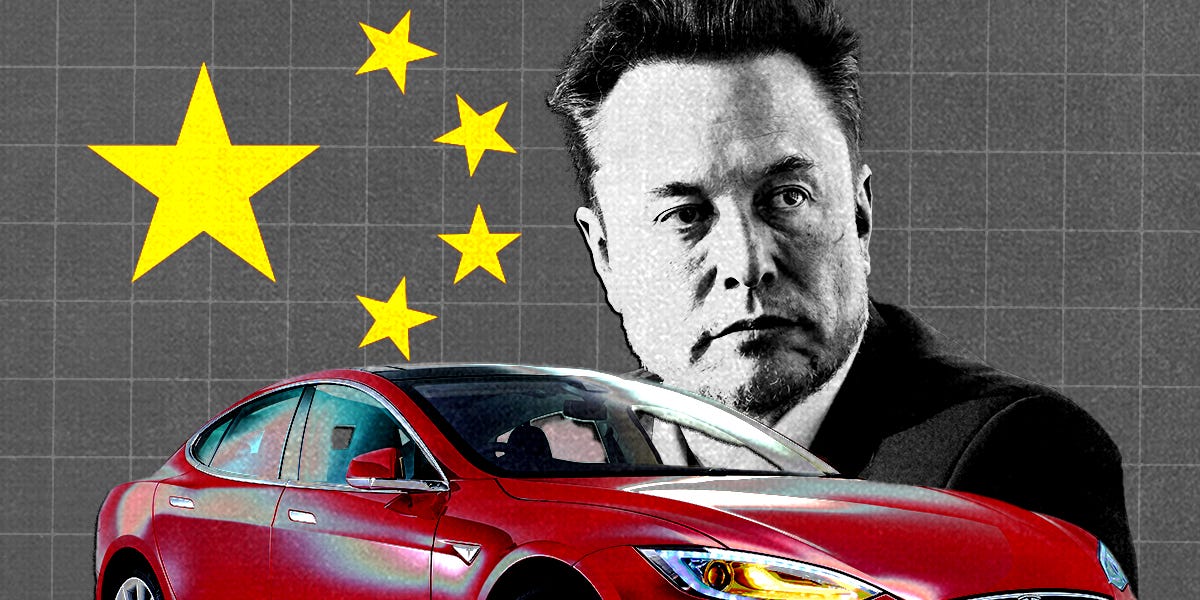

- Elon Musk’s company has also struggled to keep up with Chinese rivals’ aggressive price cuts.

BYD and Tesla both posted anemic first-quarter sales this week, serving up a reminder that demand for electric cars appears to be stalling around the world.

China, the world’s largest EV market, hasn’t been immune to the slowdown.

The country’s Passenger Car Association expects sales of new-energy vehicles to climb by 25%, to 11 million, this year, Bloomberg reported. That’s a healthy rise, but still well below last year’s growth rate of 36%.

Any signs of weakening demand in China are a red flag for Tesla, which is already struggling to keep up with its local rivals’ aggressive price cuts.

“I think a big part of Tesla’s first-quarter deliveries miss came from China,” Seth Goldstein, an equities strategist for Morningstar who chairs the research firm’s EV committee, told Business Insider. “There’s a lot of price competition, and we’re seeing consumers go to other brands with cheaper offerings.”

Tesla waves the white flag

Tesla slashed the prices of its Models 3, S, X, and Y in China last year in a bid to compete with local rivals including the market leader, BYD, which sells much cheaper vehicles, such as the $11,000 Seagull.

The cuts helped Tesla log record delivery numbers and kept its share price high — but it still lost its title as the world’s top EV seller to BYD in 2023.

CEO Elon Musk appears to have backed away from the price-cuts strategy this year, however. Goldstein said that’s a sign he knows Tesla can’t win the price war and remain profitable.

“Last year was the year of the price cut, in order to grow volumes, and it worked,” he said. “But Tesla now seems to have made the decision that for now, they’re happy where their unit profits are at.”

Holding prices steady in China appears to have backfired, though. Tesla missed Wall Street forecasts for deliveries — and Bloomberg estimated its market share in the world’s second-largest economy had fallen to about 7% from about 11% in early 2023.

STR via Getty Images

Bad news for BYD

Americans are shunning electric cars because of concerns about charging and the emergence of cheaper hybrids — but the reasons for the slowdown in China are more complex.

There are plenty of public charging stations — about 2.7 million at the end of 2023, according to the China Electric Vehicle Charging Infrastructure Promotion Alliance. And the midmarket hatchback options BYD offers are some of China’s best-selling cars.

However, some would-be buyers found local companies’ constant price cuts irritating. BYD slashed the cost of one model by a total of 15,000 yuan, or about $2,100, in a matter of months last year, reducing its value on the secondhand market and making people more hesitant to buy one.

China’s economy has also struggled since the end of the pandemic, with deflationary pressures and a property-market crisis fueling a decline in consumer spending.

BYD makes most of its sales in China — and the tally rose by about 300,000 in the first three months of the year, a stock-market filing this week said. That increase was not enough to stop Tesla from reclaiming its title as the world’s top electric-car maker despite its own dismal delivery numbers for the same period.

Tesla makes the Model 3 and Model Y at its Shanghai factory. Bloomberg reported that it recently reduced production to five days a week from 6 ½ days, in a sign of waning demand for its cars in China.

If China joins the US in loving EVs a little less, both Tesla and BYD could be in for a difficult 2024.