SoftBank has made headlines for prized investments that have filed for bankruptcy, including WeWork, Katerra, and genetic testing business Invitae. There’s an addition to the list: View, which raised $1.1 billion from SoftBank in 2018.

View makes glass for commercial-building windows that use low-voltage wiring to control the tint.

The Milpitas, California-based firm raised $815 million in its public debut in March 2021. It has run perilously low on cash several times since. View disclosed in November that it did not have enough funds to meet its operating costs and obligations beyond the first quarter of 2024 despite raising $50 million in debt financing.

Now, the company has filed for Chapter 11 bankruptcy, allowing it to reorganize without liquidating all its assets. View has $359 million in debt and $291 million in assets per its bankruptcy petition.

Two of its financiers Cantor Fitzgerald and real estate firm RXR, are taking the company private along with other real estate investors.

Cantor Fitzgerald and RXR have long relationships with View, with Cantor Fitzgerald backing its SPAC and RXR was a customer of View and sold a data product, WorxWell, to the firm. Their respective CEOs, Howard Lutnick and Scott Rechler, will join View’s board of directors.

“We are happy to partner with Cantor Fitzgerald to better position View as a private company,” RXR’s Rechler told the Commercial Observer. “We looked at it where this was a company with a broken capital structure with a product that we have applied to our buildings, making them more sustainable and a better experience for users.”

View has struggled as a public company ever since its debut on Nasdaq, which has threatened to delist View several times and determined to do so in January. View withdrew its extension request after filing for bankruptcy. It also narrowly escaped a fine from the Securities and Exchange Commission for understating its liabilities, which View did not admit or deny.

SoftBank and View did not respond to Business Insider’s request for additional comment in time for publication. Cantor Fitzgerald declined to comment beyond the release.

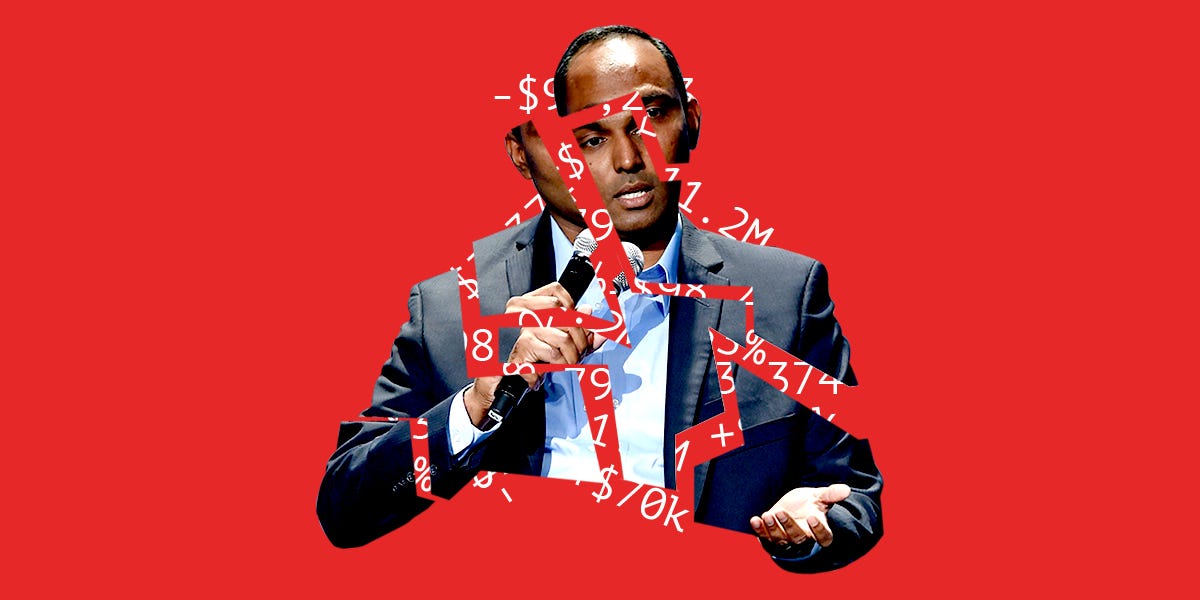

“This financial restructuring will fortify the balance sheet and provide the investment needed for View’s continued growth,” CEO Rao Mulpuri wrote in a statement. “This group of real estate operators have been working with View for quite some time and have the vision and capital to be excellent partners in helping us achieve our goal of building a profitable business going forward.”

View employees have been told that operations will “continue as normal” and they will be paid as usual, according to an internal memo obtained by Business Insider.

Mulpuri has managed to raise cash for View multiple times when funds ran low, including from the now-bankrupt financier Greensill Capital.

“He’s always been able to pull a rabbit out of a hat when it comes to procuring more money for the company,” one banker familiar with View previously told Business Insider.

For those looking from the outside, View’s troubles came on suddenly after its public debut, but insiders said the company burned cash and struggled with product failures for years. Insider spoke with 27 former employees and two current employees across View’s finance, sales, marketing, factory operations, engineering, recruiting, and IT departments.

“When I was informed of the work I would be doing to help with the SPAC, I sort of laughed inside because to me, going public was never real,” a former View IT employee told Insider. “We were way closer to going bankrupt.”